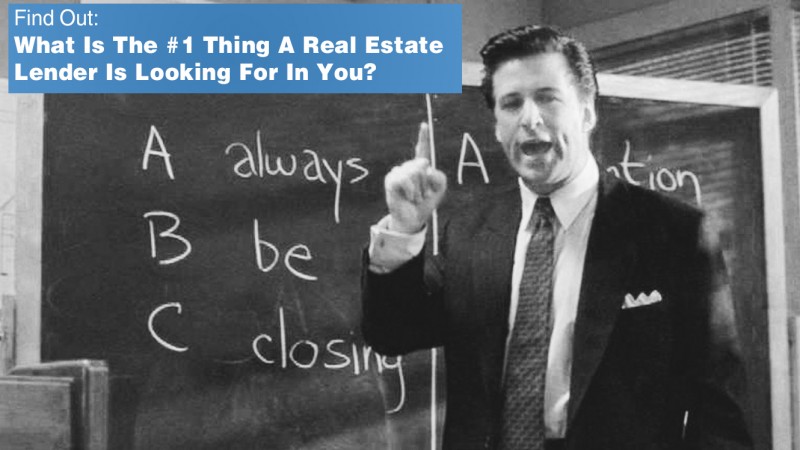

What’s a real estate investor’s favorite thing to see in you, the borrower?

…

Themselves.

Rich and Poor Priority Differences

Articles are swarming social media feeds referring to the differences between the poor and rich. The poor watch more hours of television (reality television at that), while the rich maintain a to do list, wake up 3+ hours before work, regularly read, network, and listen to podcasts/audiobooks on the commute.

When you walk from first class to coach on your flight, you’ll often notice the people in first class on their laptops- with spreadsheets open or reading a business book. While in the back, more people are watching movies or playing games.

Coincidence?

I think not.

Rich and Poor Habit Differences

The difference between the rich and poor mentality infiltrates beyond an intellectual level into the daily habits each category endorses. Some habits keep people striving and working for the rest of their lives, other habits lead to hard work (the right work) for a few years before leisure and success.

Is it any wonder 30% of US Millionaires are originally from a different country? Americans typically lead a life of privilege, entitlement and complacency. Using social media as a crutch to launch your business is not enough (although there is a way to do it right), nor is signing up for a program or having a goal to make more money faster.

Finding Private Money For Your Fix And Flip Investments

When looking to fix and flip with no money down (or little money), you have to convince your lender that you can pay the loan back. Of course there are a number of logical lending factors involved in the scenario to assess the deal, but a lender is assessing who you are by the traits they see.

First, let’s look at who a lender is, and then define the characteristics they are looking for.

Who is a lender?

- Lenders are often self-made, affluent men or women

- Lenders know the value of networking and connection

- Lenders educate themselves, continually, as a lifestyle

- Lenders have routines (i.e. wake up early, make x calls before leaving the office, following schedules, etc.)

- Lenders understand bad habits have negative impact

- Lenders set goals

Want a lender to work with you?

They are looking for the same characteristics they’ve taken pride in developing themselves:

- Independence

- Grit

- Ambition

- Persistence

- Perseverance

- Optimism

- Strength

- Confidence

- Ingenuity

- Self-Inventiveness

Why market to the Lender?

They have money, are extremely motivated to make more money, and are not risk adverse.

270 of the Fortune 400 made their fortunes from scratch, meaning 88% are like you and me.

Finding Private Money To Transform Your Life Takes You Transforming Your Life

There are a great number of variables that go into succeeding in real estate investing, but the baseline comes from your education and the aforementioned developed habits.

Change your life.

Learn real estate business through education- personal and professional development via webinar or event. If you need help finding a private money lender, click here to get in touch with my company Cogo Capital.

We use a logic based lending approach to loans. We will bend over backwards to make your deal work.